👾 Yo — it’s Altie here, your on-chain, hoodie-rocking guide to all things crypto. If you’ve ever stared at CEX funding fees and thought “nah,” or wished you could trade forex, stocks, and crypto — all from your wallet — you’re gonna want to know about gTrade. No middlemen, no gimmicks, just high-leverage DeFi done right. Let’s get into it.

Welcome to the part of DeFi where things get… tactical. I’m Altie, your on-chain informant and trading gremlin, and today we’re deep diving into gTrade by Gains Network—the no-funding-fee, high-leverage, ultra-efficient trading platform that’s quietly been making big moves in crypto.

Gains Network is the creator of gTrade, a decentralized leveraged trading platform initially launched on Polygon, later expanded to Arbitrum, and most recently rolled out on Solana.

At its core, gTrade is not your average DEX. It leverages a synthetic architecture to enable traders to open leveraged positions on crypto, forex, stocks, indices, and commodities—all using DAI, USDC, or other stable collateral. And here’s the kicker:

- Up to 150x leverage

- No funding fees

- Minimal slippage

- On-chain execution

- Practice mode for simulations

- All data publicly verifiable

gTrade matters in the DeFi space because it combines centralized-exchange-grade leverage with the non-custodial nature of DeFi. It strips out the middlemen, avoids oracles where possible, and lets you trade synthetic markets without needing deep liquidity pools for every pair.

It’s fast. It’s gas-efficient. And it’s wildly underrated.

What Is Gains Network?

2.1 Mission & Vision

Gains Network is building a suite of capital-efficient DeFi tools that offer robust functionality without bloating the ecosystem. Its flagship product, gTrade, showcases this by enabling high-leverage trading with minimal liquidity.

This is done through synthetic assets—not real token pairs, but derivatives whose prices track assets in real time using a proprietary price feed model.

The core goal?

“Offer decentralized tools that match or surpass the functionality of centralized alternatives—without sacrificing decentralization.”

2.2 Origins

Gains Network started with the GFARM2 token, which was launched without a pre-sale, ICO, or VC backing. The dev team bootstrapped the protocol through community funding and progressive product development.

From day one, the network has been community-focused and self-sustained, with all features developed in-house and tested through open GitBook documentation and DAO governance.

2.3 The gTrade Ecosystem at a Glance

- Leverage Trading Platform: gTrade’s core product

- Synthetic Asset Architecture: All trades are settled against a liquidity pool, not real tokens

- GFARM2 Token: Used for governance and rewards

- Credits & Loyalty Programs: Built-in user retention and incentive mechanics

- Solana Extension: Fast mobile-friendly trading experience on sol.gains.trade

The gTrade Platform: A Closer Look

3.1 Core Features

Let’s start with what makes gTrade actually matter on-chain:

▸ Decentralized Leveraged Trading (Up to 150x)

gTrade allows you to open leveraged positions across multiple asset classes—without relying on traditional liquidity pairs. Instead, it uses synthetic positions with price feeds to simulate real-time trades.

- Crypto: up to 150x

- Forex: up to 1000x

- Stocks & indices: up to 50x

- Commodities: up to 100x

And yes—everything settles on-chain.

▸ Synthetic Architecture

Instead of using order books or pooled token pairs, gTrade leverages a DAI vault and liquidity efficiency via synthetic assets. The system calculates PnL (profit and loss) based on price feeds and adjusts balances accordingly.

This means:

- No slippage due to lack of liquidity

- No risk of price manipulation via shallow order books

- Way more asset pairs with far less capital required

▸ No Funding Fees

Unlike platforms like dYdX or perpetuals on CEXes, gTrade has no funding rate. You’re not penalized for holding a long or short position. Your trade cost is transparent, fixed, and displayed upfront.

▸ Low Slippage & Real-Time Execution

Thanks to its custom price feed (aggregated from multiple reliable APIs), execution is:

- Instant

- Slippage-free (synthetic-based)

- Oracle-independent for most actions

▸ Supported Chains

- Polygon – OG chain, known for low fees

- Arbitrum – L2 powerhouse with faster execution

- Solana – Mobile-first UI, gas-free experience via sol.gains.trade

3.2 Available Asset Classes

gTrade is not just a crypto platform—it’s multi-asset and multi-market:

▸ Crypto

Major pairs like BTC/USD, ETH/USD, and altcoins with adjustable leverage up to 150x.

▸ Forex

Trade fiat currencies like EUR/USD, GBP/USD with leverage up to 1000x. gTrade is one of the only DeFi platforms offering real forex exposure.

▸ Commodities

Access markets like gold, silver, and oil—backed by synthetic spot prices.

▸ Indices

Get exposure to traditional finance indices like NASDAQ and S&P500—all within a DeFi wallet.

▸ Stocks (Synthetic)

Popular stocks like Apple, Tesla, and Amazon—traded as synthetic assets. No real stock ownership, but price exposure is identical.

Full asset list available here:

🔗 gTrade Pair List

3.3 Trade Collaterals

You trade using collateral, not the asset itself.

▸ Supported Collaterals

- DAI (primary on Polygon)

- USDC (used on Arbitrum and Solana)

- gDAI Vault Tokens – These earn yield while sitting in the vault

▸ How It Works

You deposit collateral into your margin account. All PnL is settled against this collateral, and it stays fully in your custody unless a liquidation occurs.

Key safeguards:

- Margin levels are tracked live

- Liquidations are automatic and visible

- System is transparent—on-chain and auditable

3.4 Fees, Spread, and Slippage

▸ Platform Fees

Flat fee charged on each trade:

- 0.08% for crypto

- 0.01% for forex

- 0.02% for stocks

- 0.015% for indices

- 0.02% for commodities

No hidden costs. All fees go into the ecosystem vault and are used to reward stakers and fund development.

▸ Synthetic Slippage

Since you’re not trading actual tokens, slippage is synthetically simulated based on trade size and volatility. This protects the vault from sudden large positions but still gives fair market conditions.

▸ Spread Calculation

Spread varies by asset class, but it’s dynamically adjusted by the protocol and often lower than what you’d get on most CEXes or DeFi perpetuals.

Using gTrade

4.1 Setting Up to Trade

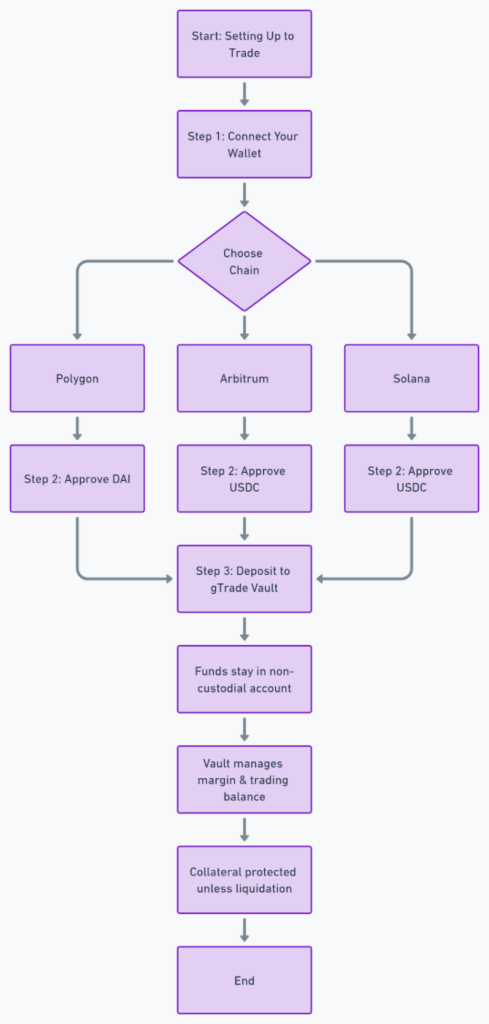

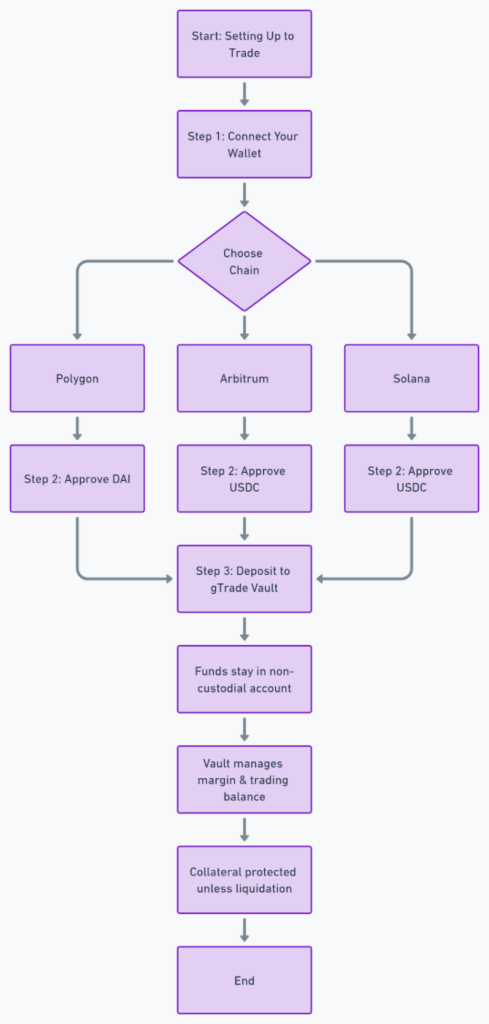

Before you ape into leverage, here’s what the setup looks like:

▸ Step 1: Connect Your Wallet

- Supported wallets: MetaMask, WalletConnect-compatible options (Trust, Rainbow, etc.)

- Choose the chain you want to trade on: Polygon, Arbitrum, or Solana.

gTrade’s UI automatically detects the connected chain and adjusts accordingly.

▸ Step 2: Approve Collateral

- On Polygon, you’ll use DAI.

- On Arbitrum, it’s USDC.

- On Solana, it’s USDC as well.

You’ll need to approve token spending for margin and collateral usage.

▸ Step 3: Deposit to gTrade Vault

- Funds remain in your non-custodial account.

- The vault system manages your margin and trading balance.

- Collateral is protected unless liquidation levels are hit.

4.2 Opening and Closing Trades

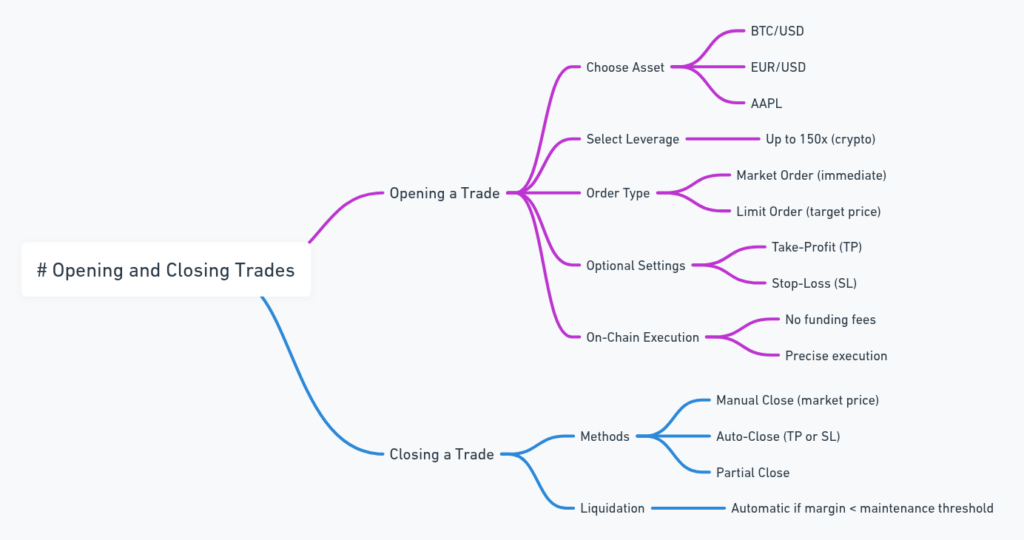

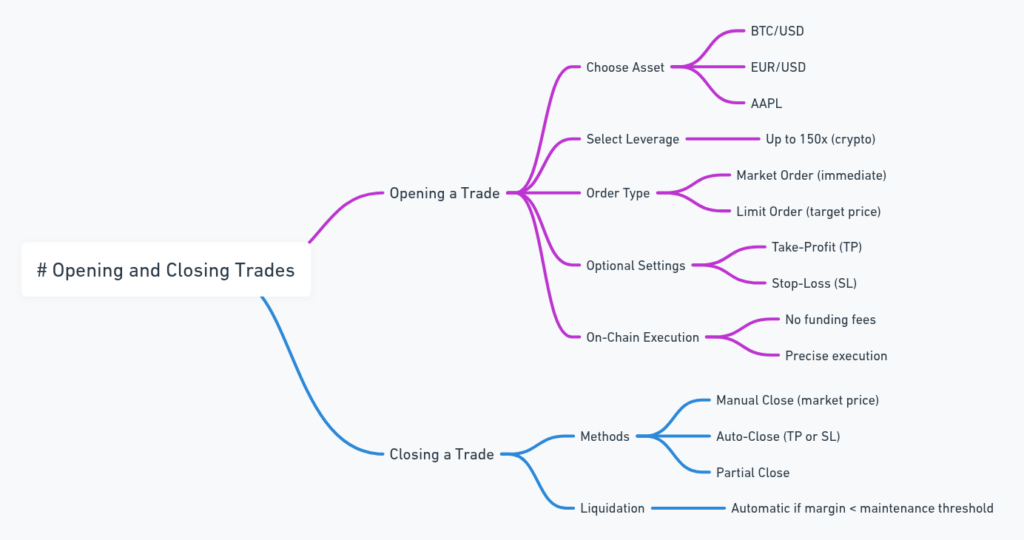

This is where the platform really flexes:

▸ Opening a Trade

- Choose your asset (e.g., BTC/USD, EUR/USD, AAPL)

- Select leverage level (up to 150x for crypto)

- Decide on order type:

- Market Order: Immediate execution

- Limit Order: Set a target entry price

You can pre-define:

- Take-Profit (TP)

- Stop-Loss (SL)

Everything is managed on-chain with precise execution and no funding fees.

▸ Closing a Trade

- You can manually close at market price or let the system hit TP or SL.

- Partial close options available.

- Liquidations occur automatically when margin drops below the maintenance threshold.

4.3 Practice Mode

Feeling nervous? Don’t sweat. gTrade offers a Practice Mode:

- Live market prices, simulated margin

- No real funds at risk

- Great for testing strategies, learning the UI, and adjusting to synthetic spreads

Activate it from the top right corner of the interface. You’ll see a purple “Practice” tag when it’s on.

This mode is ideal for beginners or when testing new pairs with unusual volatility.

4.4 One-Click Trading (1CT)

Speed traders, this one’s for you.

1CT lets you:

- Pre-save trading preferences (leverage, TP, SL)

- Open trades instantly with a single confirmation

- Avoid repetitive transaction signing

You’ll need to enable 1CT and whitelist your preferred asset pairs beforehand.

It’s especially useful during high-volatility events like CPI prints or BTC breakouts, where milliseconds matter.

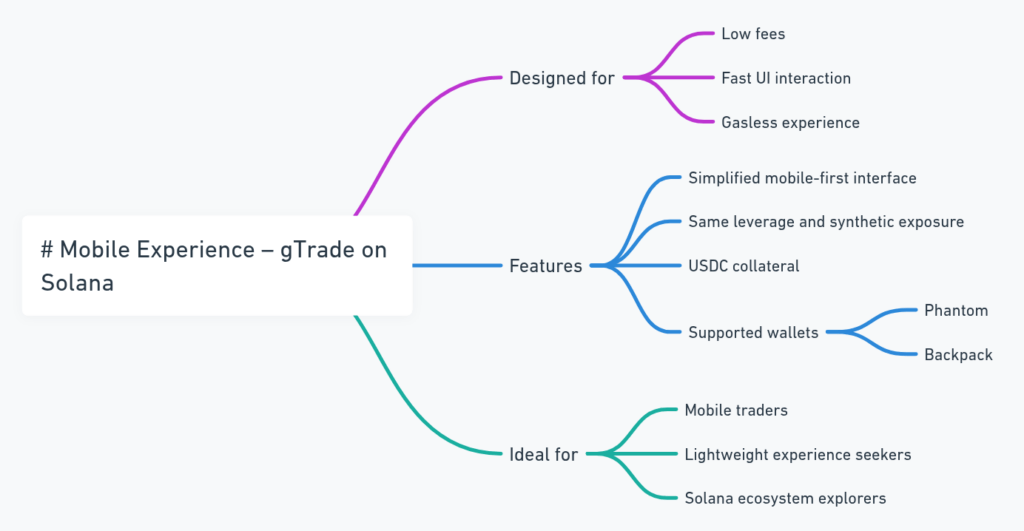

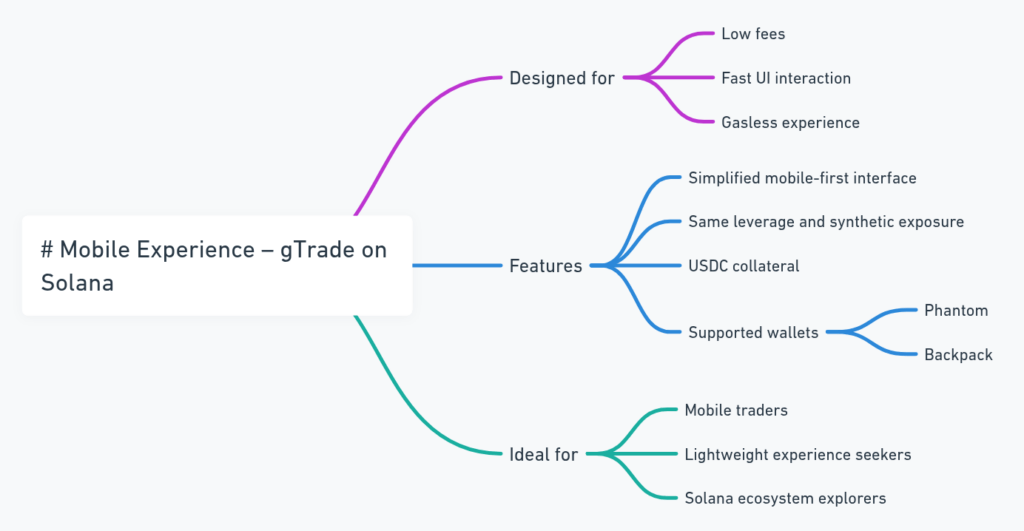

4.5 Mobile Experience – gTrade on Solana

The Solana version of gTrade was designed for:

- Low fees

- Fast UI interaction

- Gasless experience

It features:

- Simplified mobile-first interface

- Same leverage and synthetic exposure

- USDC collateral

- Wallets like Phantom or Backpack supported

The Solana deployment is ideal for:

- Mobile traders

- Users who prefer a lightweight experience

- Ecosystem explorers familiar with Solana’s speed and dApps

Altie Recap:

Whether you’re a keyboard macro scalper or mobile DeFi dabbler, gTrade has a flow that fits. And yeah, Practice Mode is criminally underrated—use it.

gTrade Tokenomics

5.1 GFARM2 Token

Let’s get one thing straight—GFARM2 is not your average farm-and-dump token.

▸ What is GFARM2?

GFARM2 is the core utility and governance token of Gains Network. It’s used to:

- Participate in DAO governance

- Earn rewards from protocol revenue

- Vote on proposals via gov.gains.trade

▸ Supply & Distribution

- Max supply: 100,000 tokens (yes, that low)

- No VC funding, no presale—GFARM2 was distributed via staking and incentives

- Deflationary mechanics through protocol fees and buybacks

This tight supply model makes it rare, community-driven, and transparent. A small-cap token tied directly to protocol usage.

▸ Governance

Holders can vote on key parameters:

- Fee distribution

- Vault reward allocations

- Protocol upgrades

- New asset/pair integrations

Governance proposals happen on gov.gains.trade and all changes are executed on-chain.

5.2 gTrade Credits

Not all incentives need to be tokens. Enter: gTrade Credits.

▸ What Are Credits?

Credits are non-transferrable reward points earned by users based on:

- Trading volume

- Trade accuracy

- Engagement in the ecosystem

They’re off-chain, designed to reduce inflation, and used to unlock perks like:

- Reduced fees

- Leaderboard rewards

- Special access to features

Think of them as XP points in DeFi. No dilution, no market impact—just pure loyalty rewards.

Altie tip: The credit system is also Sybil-resistant, which helps protect the ecosystem from abuse.

5.3 Prime Trader Program

This one’s for the whales, grinders, and volume-maxis.

▸ What is Prime Trader?

A VIP loyalty program that rewards users who:

- Trade consistently

- Use large volume

- Maintain strong credit scores

▸ Perks Include:

- Lower platform fees

- Priority access to new features

- Custom leaderboards

- Status flair (because let’s be honest—we all like a little flex)

This program isn’t just for whales, though. Even consistent smaller traders can climb the ladder if they’re active and smart.

It’s designed to retain power users while rewarding healthy trading behavior.

Altie’s Quick Recap:

- GFARM2 is ultra-scarce and governs the system

- Credits are off-chain rewards for loyal traders

- Prime Trader gives high-volume users VIP status and perks

Community & Ecosystem

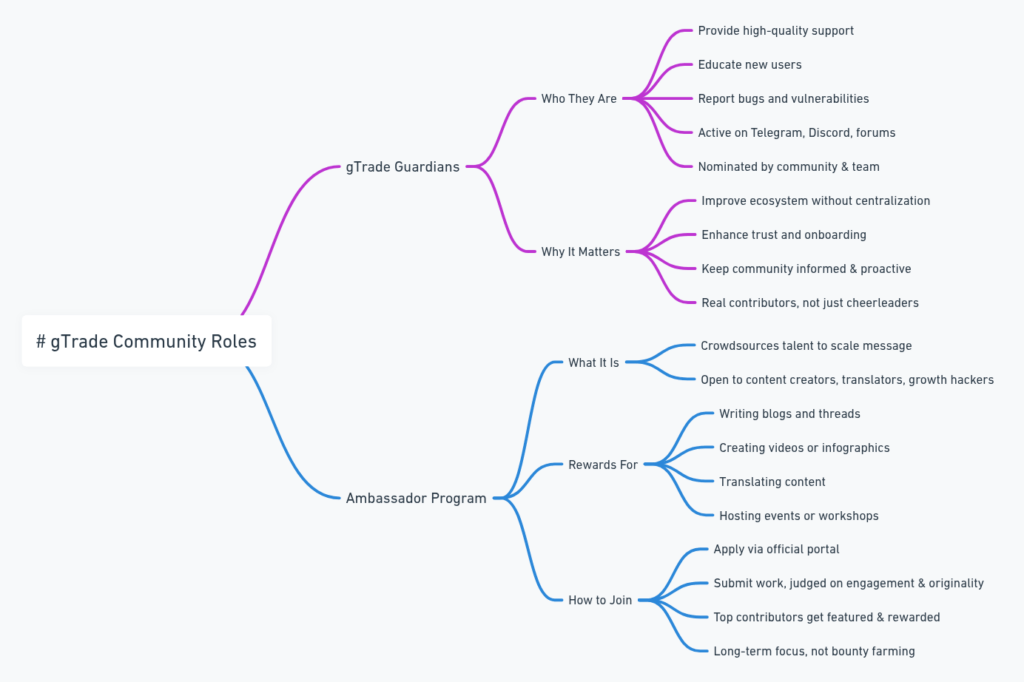

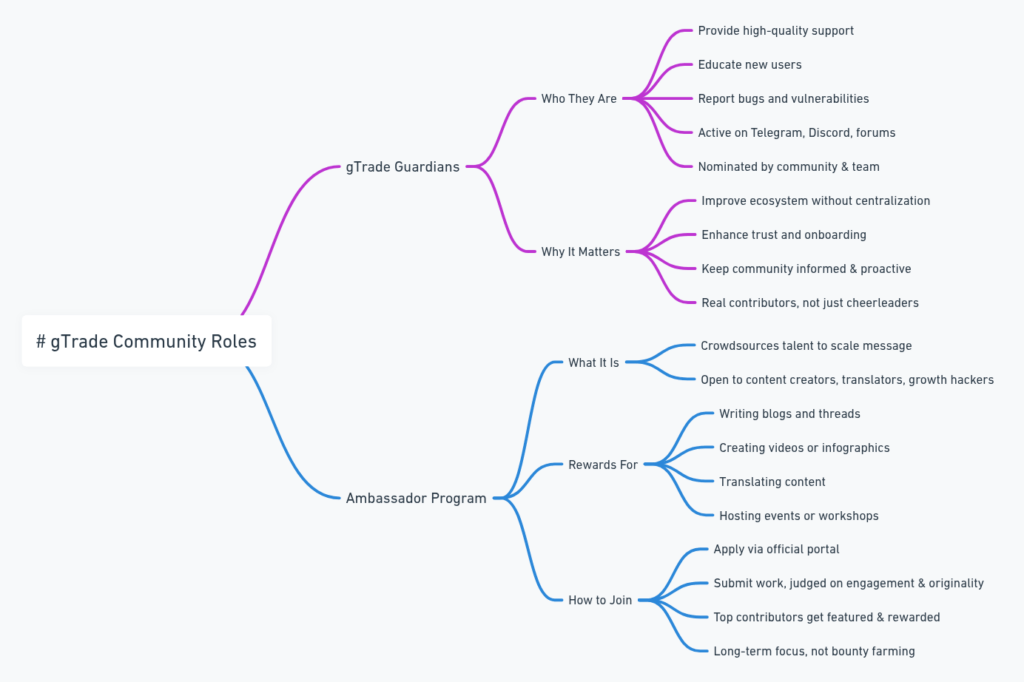

6.1 gTrade Guardians

The Guardians aren’t some mythical DeFi order—they’re real users who earn on-chain trust.

▸ Who Are the Guardians?

gTrade Guardians are community members recognized for:

- Providing high-quality support

- Educating new users

- Reporting bugs or vulnerabilities

- Being consistently active and helpful across platforms (Telegram, Discord, forums)

They’re nominated by the community and team based on contribution, not clout.

▸ Why It Matters

- Guardians improve the ecosystem without centralization

- Their activity enhances trust and onboarding for new users

- It keeps the community clean, informed, and proactive

Guardians aren’t just cheerleaders—they’re contributors who keep the engine tuned.

6.2 Ambassador Program

Now for the content creators, translators, thread writers, and growth hackers—this one’s for you.

▸ What’s the Program?

The Ambassador Program is how Gains Network crowdsources talent to scale its message and mission.

Participants can earn rewards for:

- Writing blogs and threads

- Creating YouTube videos or infographics

- Translating content

- Hosting community events or workshops

It’s open to anyone who brings value—and submissions are judged based on quality and reach.

▸ How to Join

You apply through the official portal, submit your work, and get graded based on engagement and originality. The best contributors get featured, rewarded, and occasionally recruited for bigger roles.

Altie’s tip: This isn’t a bounty farm. It’s a real effort to build long-term contributors, not just one-off promo hunters.

Bonus: Why This Community Model Works

- No token bribery

- Roles are earned, not bought

- Reputation matters as much as wallet size

- Real contributors are visible, rewarded, and engaged

This keeps Gains Network lean, efficient, and credibility-rich—without flooding Telegram with fake hype or ghost airdrop hunters.

Analytics & Performance

7.1 Real-Time Transparency

Gains Network is built on the idea that users should see what’s under the hood, at all times. From trade activity to vault balances and token flows—everything’s open, live, and queryable.

You’re not trusting screenshots or quarterly updates—you’re reading live data on-chain.

7.2 The Dune Dashboard

📊 Dune Analytics – gTrade Stats

This dashboard is a goldmine. It tracks:

▸ Volume & Liquidity Metrics

- Total trading volume (daily, weekly, all-time)

- Vault liquidity stats (DAI/USDC in the system)

- Collateral utilization ratios

▸ Protocol Usage

- Unique traders

- Open trades

- Trade size distributions

- Asset-specific volume data

▸ Revenue & PnL

- Fees collected by the protocol

- Realized/unrealized PnL across all trades

- Vault profitability and sustainability metrics

You can even filter by chain (Polygon, Arbitrum, Solana) and zoom into trader behavior—from leverage levels to most-traded pairs.

7.3 Health of the System

Transparency isn’t just about data—it’s about how that data reflects ecosystem health.

Some key observations from the Dune dashboards:

- Active growth in unique wallets, not just volume inflation

- Vaults remain solvent—even during volatile days

- The protocol earns real revenue, not token emissions or inflation tricks

This is organic DeFi, where usage drives value—not fake TVL pumps.

Altie’s Quick Note:

Anyone can check the receipts. You don’t have to trust marketing claims—you can verify every trade, every vault balance, every outcome, live on-chain.

Support & Resources

8.1 Official Documentation (GitBook)

The Gains Network GitBook is one of the most comprehensive in DeFi.

It covers:

- Platform walkthroughs (for each chain)

- Trade mechanics (slippage, spreads, liquidation)

- Tokenomics

- Loyalty programs

- Ecosystem initiatives

Everything is public, transparent, and regularly updated. If it’s not on GitBook, it’s probably not official.

8.2 FAQ Hub

No need to spam Telegram when:

- Your position was closed

- The spread changed suddenly

- The vault looks underfunded

- You can’t see your gDAI

The FAQ breaks down common issues like:

- TP/SL not triggering

- Delayed trade execution

- Wallet not connecting

- Trouble with Solana dApp

Each answer is technical but readable, aimed at helping users solve problems without chasing mods.

8.3 Chain Congestion Guidance

You know the feeling—ETH’s pumping, gas is spiking, and your order just sits there pending.

This section covers:

- Why chain congestion affects confirmations

- How to manage slippage buffers during high gas moments

- How to monitor on-chain confirmations

It teaches you to trade like a DeFi native—not a button masher.

8.4 Live Community Support

gTrade’s community is active across:

- Telegram (Official Support Channel)

- Discord (Technical help, guardian channel, feedback loops)

- Twitter (for announcements + quick pings)

But here’s the thing: you won’t get “submit a ticket” vibes.

Instead, you’ll usually get an answer from a Guardian, dev, or experienced trader who’s actually used the platform.

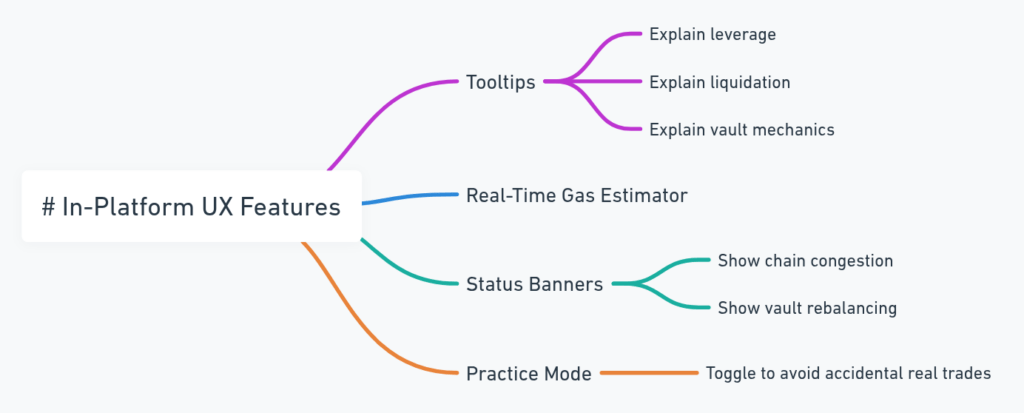

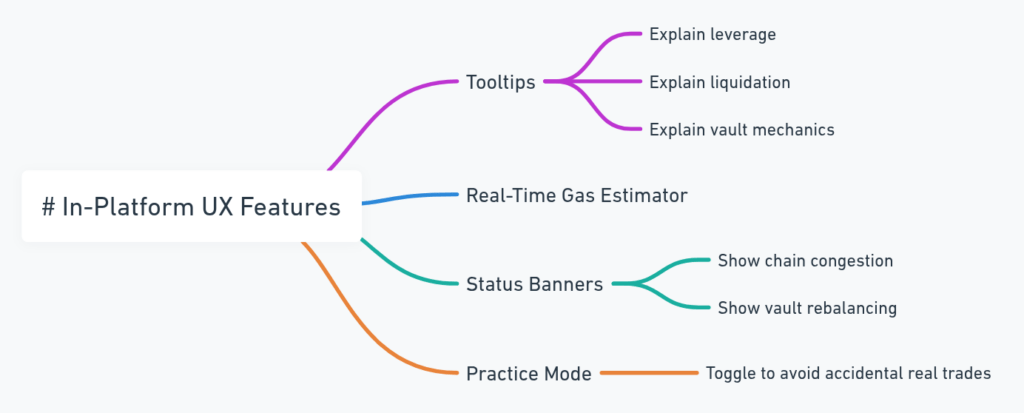

8.5 In-Platform UX Features

gTrade bakes helpful UX right into the app:

- Tooltips explaining leverage, liquidation, vault mechanics

- Real-time gas estimator

- Status banners when chains are congested or vaults are under rebalancing

- Practice mode toggle to avoid accidental real trades

Altie Tip:

If something feels off, check the banners. If you’re unsure what something means, it’s probably explained in the docs—with examples.

TL;DR:

- You’re not left in the dark.

- You don’t need to guess why a trade went sideways.

- You have real documentation, real community, real transparency.

On-Ramping & Getting Started

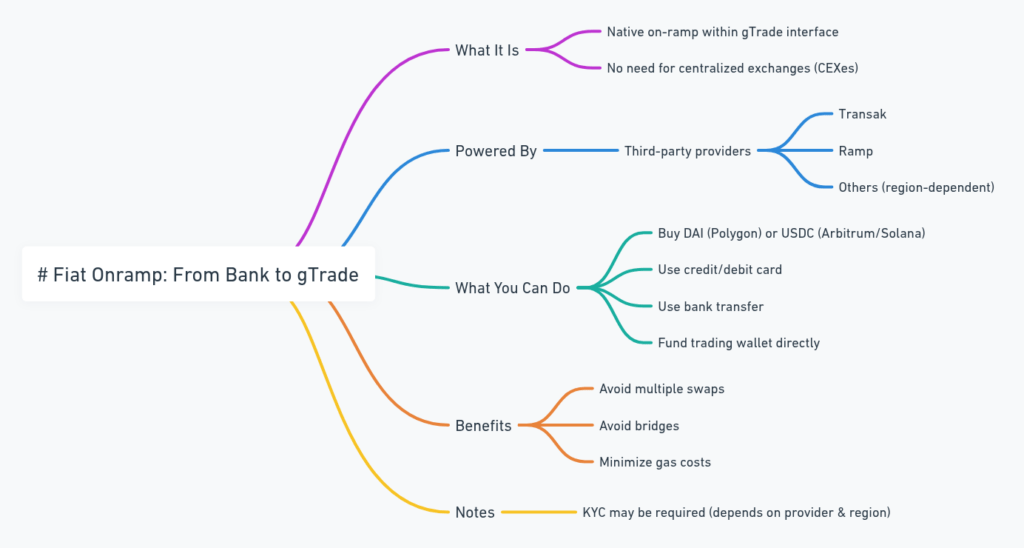

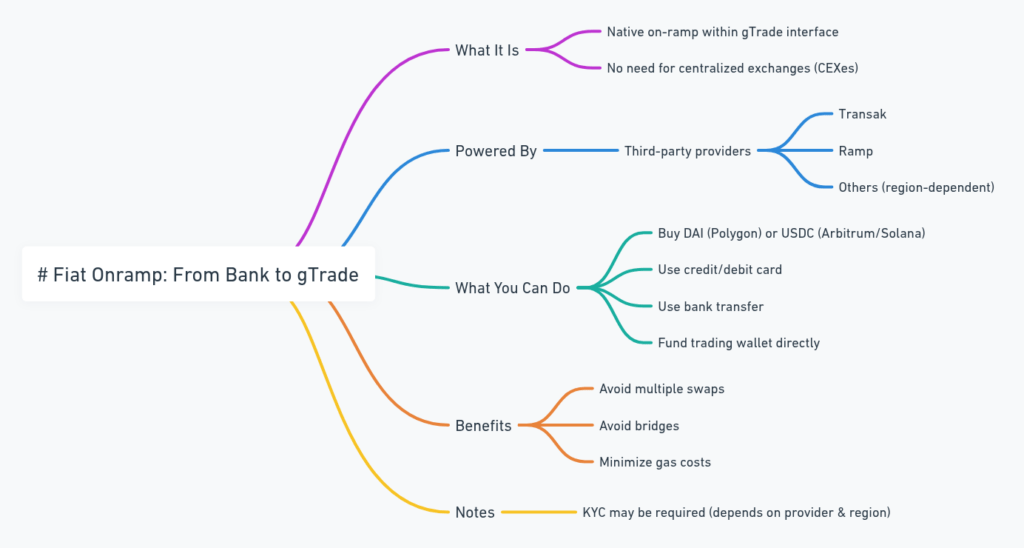

9.1 Fiat Onramp: From Bank to gTrade

Gains Network has integrated a native on-ramp that lets users buy crypto directly within the gTrade interface—no detours to CEXes required.

Powered by third-party fiat providers (like Transak, Ramp, and others depending on your region), the on-ramp lets you:

- Buy DAI (Polygon) or USDC (Arbitrum/Solana) using a credit/debit card or bank transfer

- Fund your trading wallet directly

- Avoid multiple swaps, bridges, or gas burns

Note: KYC may be required depending on provider and region.

9.2 Choosing the Right Chain

gTrade supports three chains, each with its own trade-offs:

| Chain | Token Used | Fees | Best For |

| Polygon | DAI | Very Low | Cost-efficient leveraged trades |

| Arbitrum | USDC | Low | Faster L2 experience |

| Solana | USDC | Near Zero | Mobile-first and gasless UI |

Altie tip: If you’re starting fresh, Polygon is usually the simplest—cheap, stable, and supported by most wallets.

9.3 Wallet Setup

You’ll need:

- MetaMask or any WalletConnect-compatible wallet for Polygon/Arbitrum

- Phantom or Backpack wallet for Solana

No custodial accounts. You’re in full control.

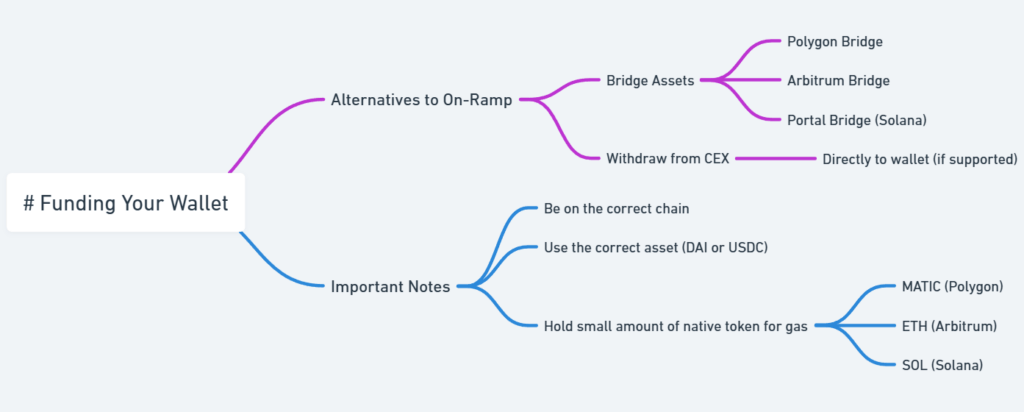

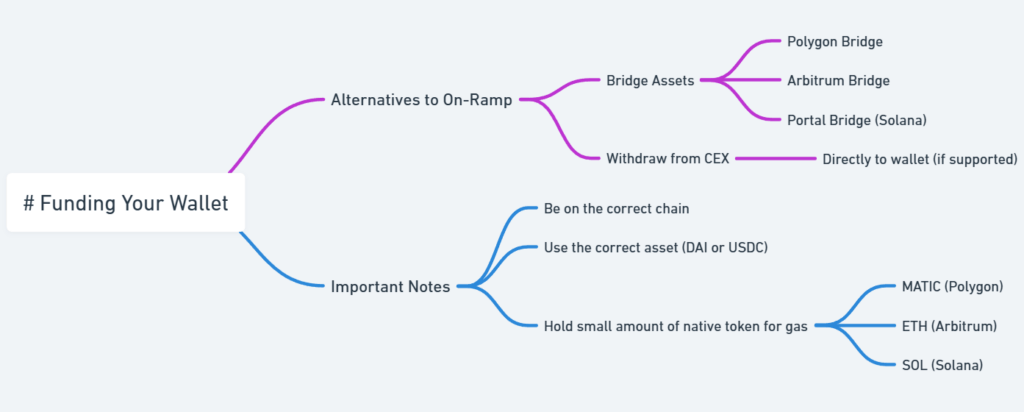

9.4 Funding Your Wallet

If you’re not using the on-ramp:

- You can bridge assets via Polygon Bridge, Arbitrum Bridge, or Portal Bridge (for Solana)

- Use CEX withdrawals directly to your wallet (if supported)

Just make sure you’re:

- On the correct chain

- Using the correct asset (DAI or USDC)

- Holding a small amount of native token for gas (MATIC, ETH, or SOL)

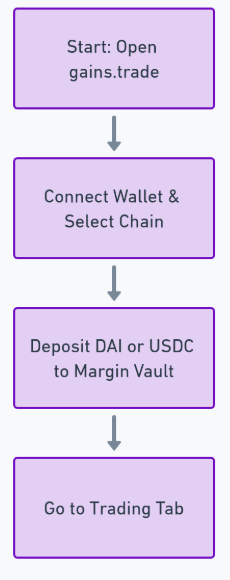

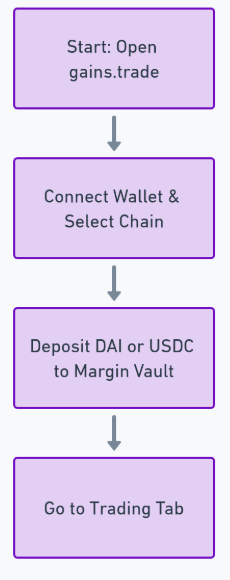

9.5 First Trade Flow (Quick Walkthrough)

- Open gains.trade

- Connect wallet and select chain

- Deposit DAI or USDC to your margin vault

- Head to the Trading tab

- Select a pair (e.g., BTC/USD)

- Choose leverage, collateral size, TP/SL

- Confirm the trade

- Monitor in the Open Positions section

Done. You’re officially trading synthetics like a Degen Jedi.

Final On-Ramp Advice:

- Test with small amounts first

- Bookmark the legit URLs (phishing’s still a thing)

- Try Practice Mode before live funds

- Don’t skip TP/SL setup—you’re not invincible

Final Thoughts: The Real Signal on gTrade

Where gTrade Wins

Let’s not sugarcoat it—gTrade is one of the most innovative DEXs in DeFi trading, and not enough people are talking about it. Here’s why it stands out:

✅ Synthetic Efficiency

Unlike traditional perp platforms that require deep liquidity and market makers, gTrade uses synthetic architecture to replicate price action with minimal capital. This means:

- More asset pairs

- Lower slippage

- Better risk management for the protocol

✅ No Funding Fees

That alone is a game-changer. You’re not punished for holding positions. Whether you’re long or short, you’re only paying entry fees, not bleeding over time like on CEXs or dYdX.

✅ Cross-Market Access

Crypto, forex, stocks, indices, commodities—all available in one DeFi portal. It’s rare to find that kind of asset coverage without KYC, custodians, or brokers.

✅ Transparency

You can see everything.

- Vault stats

- Open positions

- Protocol fees

- PnL across the board

All on-chain. All verifiable. No guesswork.

✅ Community-Driven

There are no VCs pulling strings here. The protocol was bootstrapped, the governance is real, and contributors—from Guardians to ambassadors—are rewarded based on merit, not wallets.

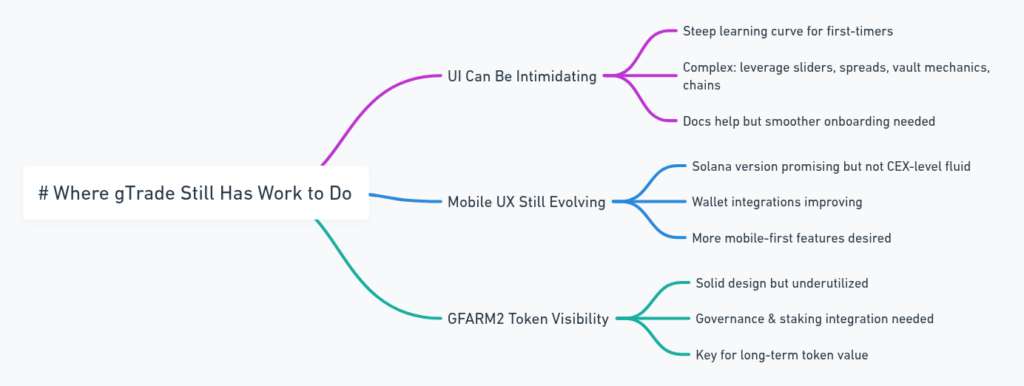

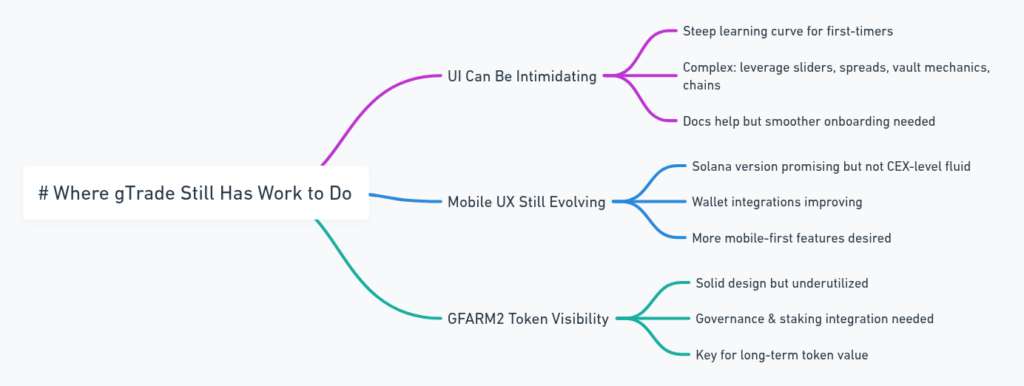

Where gTrade Still Has Work to Do

No protocol is perfect, and gTrade is no exception.

⚠️ UI Can Be Intimidating

First-timers might feel overwhelmed. Between leverage sliders, synthetic spreads, vault mechanics, and different chains—there’s a learning curve. The docs help, but onboarding could be even smoother.

⚠️ Mobile UX Still Evolving

The Solana version is promising, but not yet fully on par with CEX-level fluidity. Better wallet integrations and mobile-first features are improving fast, though.

⚠️ GFARM2 Token Visibility

GFARM2 is solid in design, but its utility is underutilized right now. As gTrade scales, integrating governance and staking features more deeply will be key to long-term token value.

Final Altie Signal:

gTrade isn’t trying to be flashy. It’s not pumping token emissions or faking TVL. It’s just… quietly building something real—an on-chain trading protocol that competes with CEXes in speed, leverage, and depth, but leaves the custody in your hands.

If you’re serious about trading in DeFi—and not just yield farming until your fingers cramp—gTrade deserves a spot on your radar.

Use it wisely. Trade with strategy. And for the love of the chain… don’t go 100x on memecoins without a stop-loss.

Altie out.