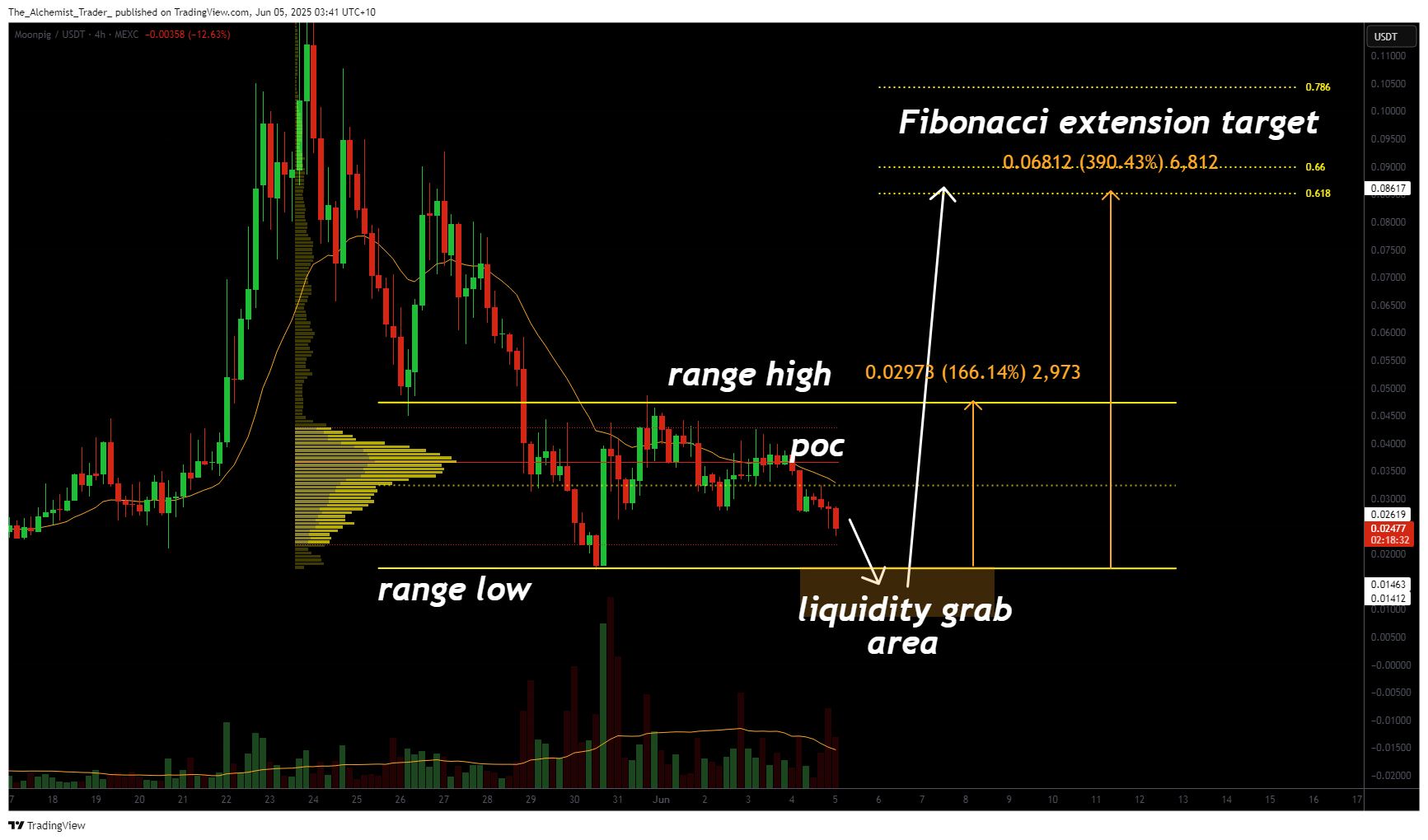

Moonpig has faced a steep 33.91% correction, pushing price action toward a critical inflection point at the local range low. With the current trading range spanning over 166%, volatility is expected to surge, making the next move a key signal for traders.

After a sharp 33% pullback, Moonpig (Moonpig) is now trading at a crucial level near its local range low. This zone could act as a springboard for a potential liquidity grab and reversal setup, commonly referred to as a swing failure pattern. With a vast trading range and the current structure still ranging, traders are watching closely for signals of structural change.

Key Technical Points

- Range Low Liquidity Zone: Price is hovering above the local range low, where a sweep of liquidity could lead to a bullish SFP reversal back into the range.

- Point of Control Resistance: The POC within the range has historically acted as resistance; breaking and holding above it could set up a grind toward the range high.

- Fibonacci Extension Target: If the range high is breached with momentum, the next target lies 390% higher based on Fibonacci extension projections.

Moonpig’s 33% decline has brought it close to the bottom of its well-defined trading range. If the current local low is breached, it may result in a classic swing failure pattern, where price momentarily dips below support to grab liquidity before snapping back inside the range. This pattern is often used by experienced traders as a high-probability long setup.

At present, the market is not showing a bullish structure. Instead, price action remains rotational, trading within a 166% wide range. Until there’s a structural shift, the base assumption is for continued range-bound behavior.

Within this range, the point of control sits below the range high and has been a strong reaction zone in the past. Price has repeatedly wicked into this area, only to rotate lower. If price action can reclaim and consolidate above the POC, the probability of a move toward the range high increases substantially.

A breakout beyond the range high would open the door for a much larger move, targeting a Fibonacci extension level over 390% above current levels. However, until that occurs, volatility within the current range should be expected, with the bias favoring mean-reversion setups.

What to expect in the coming price action

Moonpig remains in a large consolidation phase. If price sweeps the current range low and reclaims it, this could be the first signal of a structural shift and bullish reversal.

Traders should watch for an SFP confirmation and a reclaim of the POC to validate upside potential. Until then, rotational price action within the range remains the most likely scenario.