Bitcoin hit a new all-time high at $123,218, on Monday, July 14. The largest cryptocurrency wiped out its gains and hovers above the $118,000 level at the time of writing. Bitcoin’s recent activity has motivated BTC holders from the Satoshi era to move their BTC to OTC desks and likely take profits.

Bitcoin (BTC) could rally towards its target above $150K if BTC continues to extend its gains and upward momentum is sustained.

Bitcoin hits new all-time high

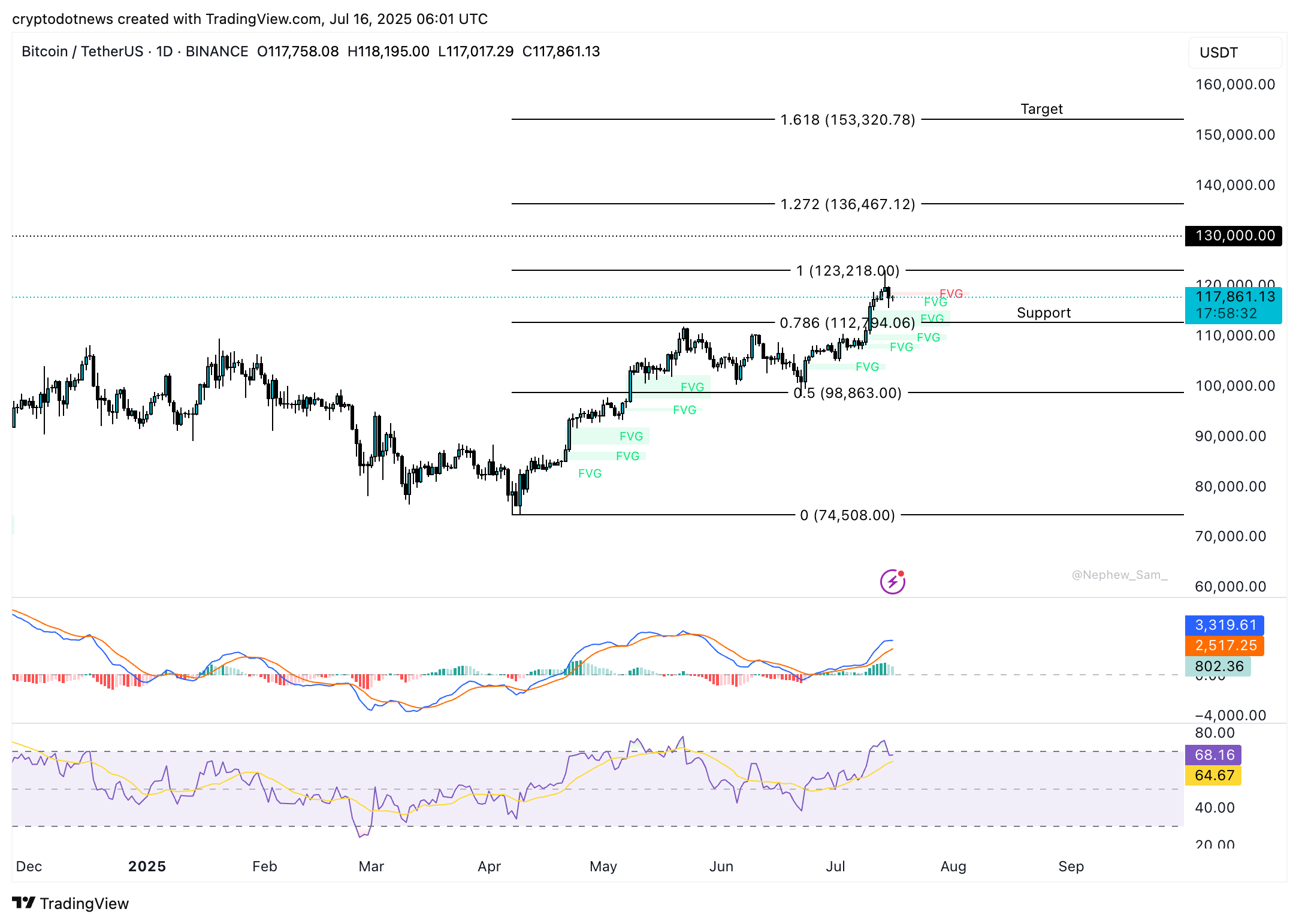

Bitcoin hit a peak at $123,218 on Monday, July 14. The largest cryptocurrency slipped lower, erasing newfound gains to hover above $118,000 on Thursday. Bitcoin could collect liquidity at the support at 78.6% Fibonacci retracement level of the rally from the April low to the July peak, at $112,794.

Two key momentum indicators on the BTC/USDT price chart show that further gains are likely in Bitcoin. RSI reads 68 and is sloping upwards, MACD flashes green histogram bars above the neutral line. There is a positive underlying momentum in Bitcoin price.

Fibonacci targets of 127.2% at $136,467 and 161.8% at $153,320 come into play once Bitcoin sees a daily candlestick close above $130,000.

The $150,000 target is psychologically important, a key milestone for Bitcoin after $100,000 and the $120,000 level.

Bitcoin’s run to a new all-time high powered the BTC trade of the century. Gemini’s Winklevoss brothers’ $11 million Bitcoin purchase in 2013 has turned into $11 billion in 2025. The 1000x increase in the Winklevoss brothers’ investment has supported the positive sentiment among traders.

Traders are “greedy” this week, according to the Fear & Greed index, a sentiment gauge for market participants.

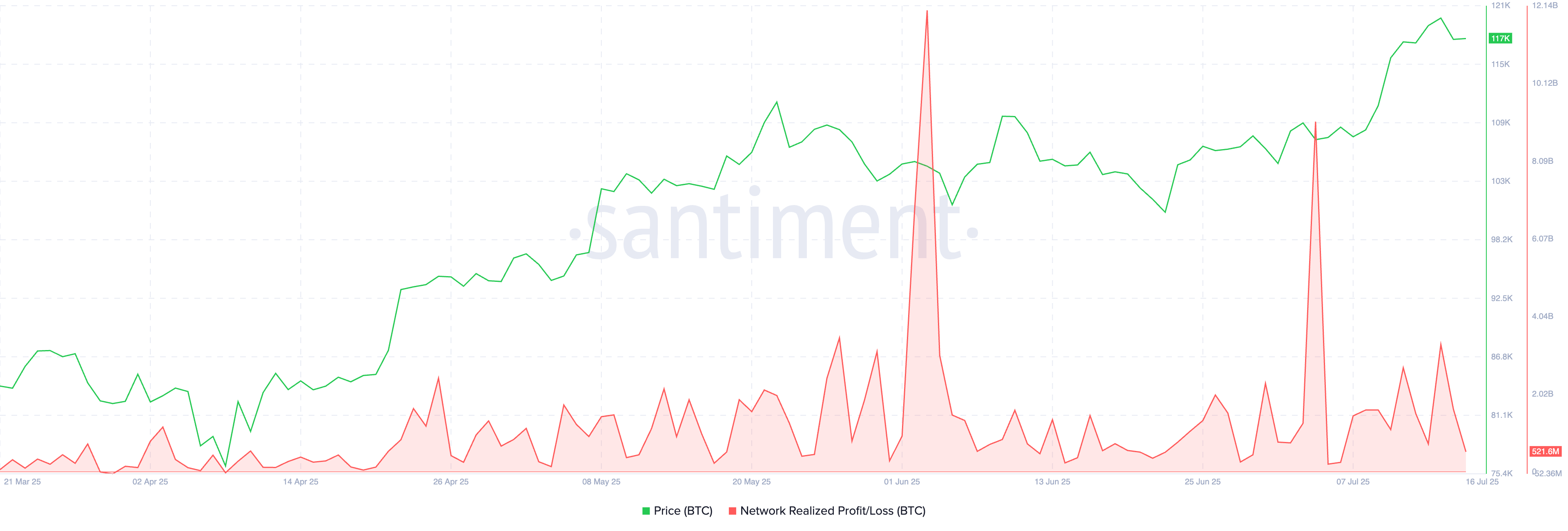

The bullish sentiment is faced with profit-taking from traders. In the past 100 days, BTC holders have consistently taken profits on their Bitcoin holdings. Santiment data shows large spikes and consistent positive spikes in the network realized profit/loss metric, between April and July 2025.

BTC eyes rally to $150K

Bitcoin’s recent gains and price discovery have ushered confidence in both institutional and retail traders waiting to deploy capital. Silicon Valley giant Peter Thiel made a big bet on a BTC mining company, sending its stocks soaring overnight. Thiel announced a 9% stake in BitMine.

The announcement supported a bullish thesis for the cryptocurrency. As BTC positions for further gains, a rally above $150,000 is likely.

At the time of writing Bitcoin slipped to the $114,000 level, testing support. Bulls are defending Bitcoin’s support levels and a re-test of resistance at $116,000, $120,000 and $123,000 is likely.

A break above the three resistances could see Bitcoin enter price discovery and rally towards the $150,000 target.

Vikram Subburaj, CEO, Giottus, an exchange platform, commented on Bitcoin price action and future targets. Subburaj told Crypto.news:

“The critical question for Bitcoin is this: where are we headed next? $135,000 is likely the next key resistance according to fib extensions. If macro liquidity remains supportive and ETF inflows persist, we expect this growth phase to stretch to $150,000 and beyond. It is sure that volatility will remain with sharp corrections along the way. But the broader direction is unmistakably upward.”

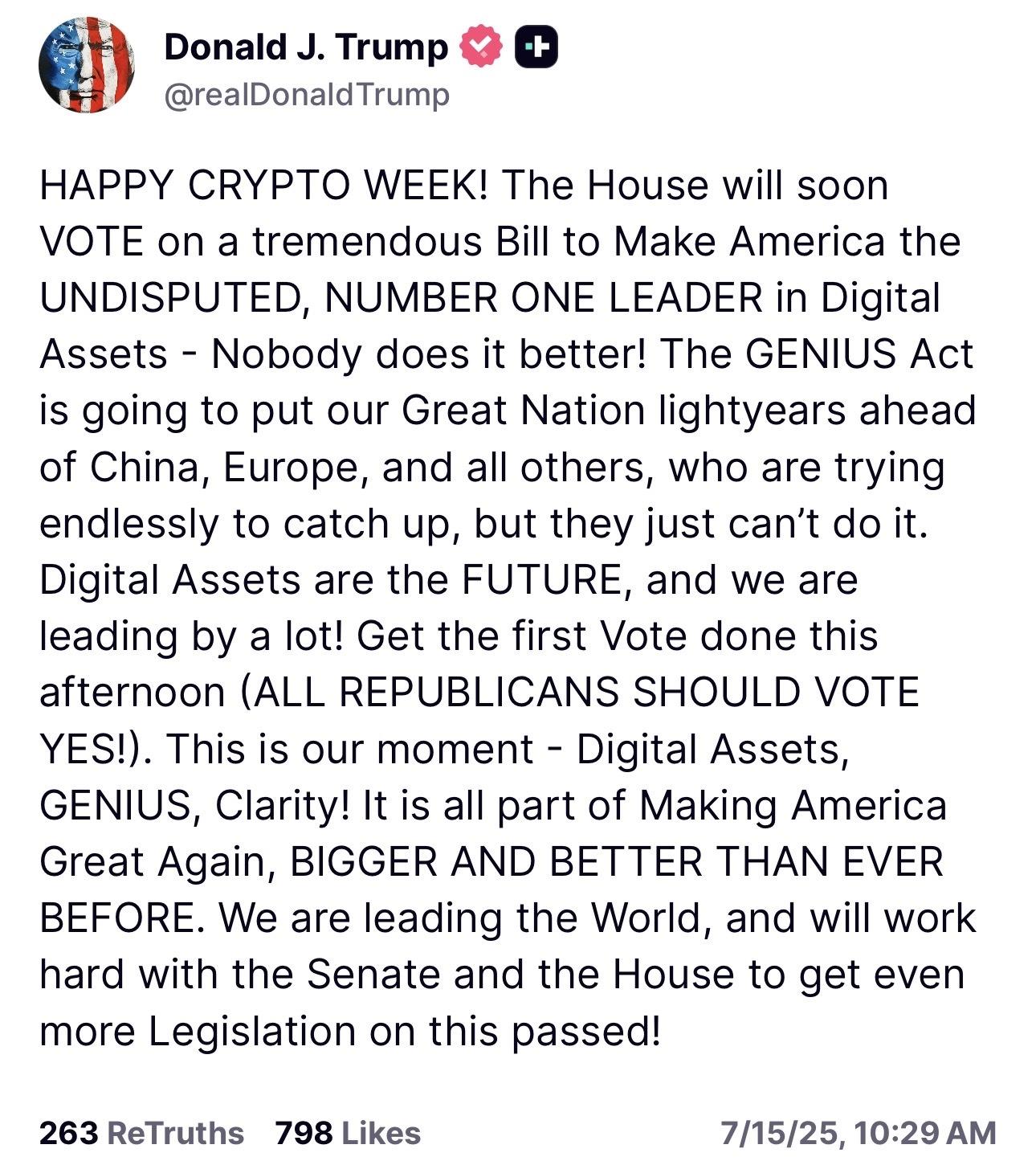

Trump’s crypto week

US President Donald Trump kicked off the crypto week with an announcement on social media platform TruthSocial. Trump assured market participants that the House will soon vote on a bill that could make America the undisputed leader in digital assets.

Trump stated that he would work with the House and the Senate to get even more legislation passed.

Legislation on stablecoins has been stalled, and disagreement has previously blocked the bills from advancing. It remains to be seen how the three crypto-related bills would be passed and whether the administration takes more measures to address the crypto market structure.

On-chain analysis

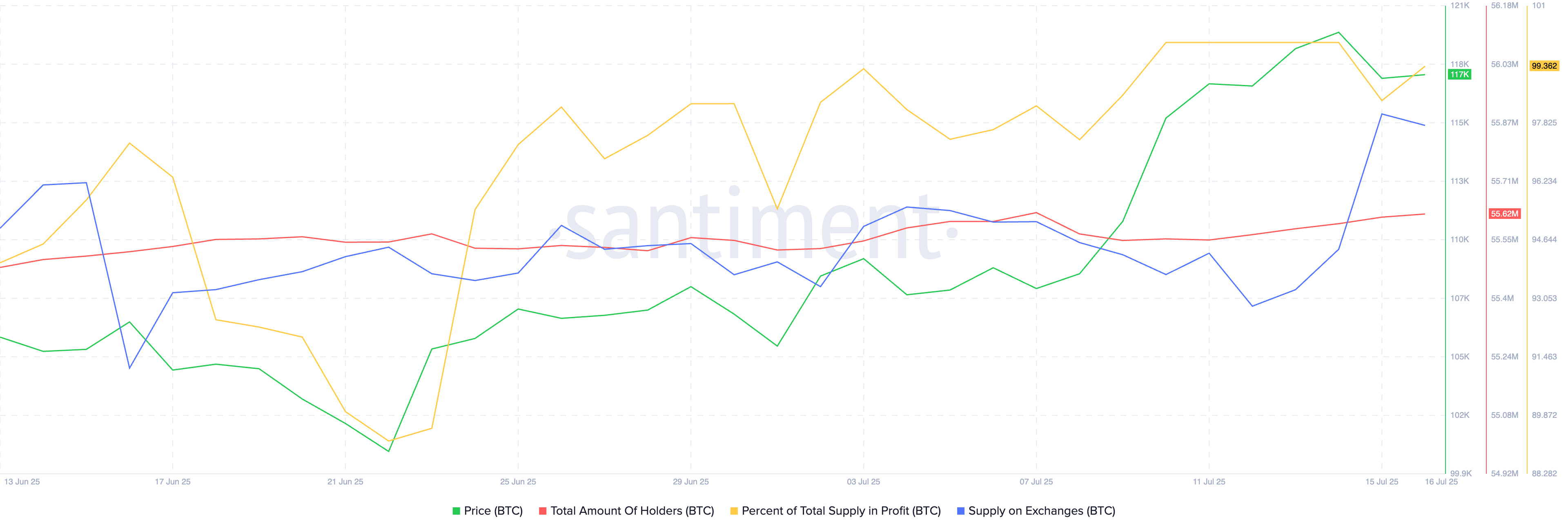

Santiment data shows that the total number of Bitcoin holders has increased in the last week. However, the percent of supply on exchanges dropped after an initial spike. As the percentage of BTC supply in profit climbed, supply on exchanges dipped. This could mean BTC is being pulled out of exchanges for holding rather than profit-taking.

The metric that tracks profit-taking shows no significant spike in the last week meaning traders on exchanges are capable of absorbing the selling pressure, and supporting Bitcoin price gains.

On-chain analysis shows Bitcoin’s retail traders taking profits and redistributing their holdings while giants and large wallet investors accumulate throughout the price rally. Strategy has bought nearly every Bitcoin price dip and added another 4,000 BTC to its holding at an average price of over $111,000 per token. The giant has consistently scooped up Bitcoin in the 2025 bull run.

Andrejs Balans, risk manager at YouHodler, an EU-based fintech platform told Crypto.news in an interview:

“Bitcoin’s market has matured considerably, with improved liquidity and participation by professional trading firms. This evolution has reduced volatility compared to past cycles, a sign of a more resilient market but also a factor that can dampen large speculative moves.

Following significant gains this year, many long-term holders have realized profits, thereby adding to the market’s supply. Without sustained fresh demand, this selling pressure could keep prices range-bound rather than driving a decisive breakout.”

Jamie Elkaleh, Chief Marketing Officer at Bitget Wallet said:

“Institutions are now firmly driving Bitcoin’s growth, with over $50B in ETF inflows and sustained accumulation by players like BlackRock and MicroStrategy signaling long-term confidence. A short-term pullback looks unlikely, with Bitcoin more likely to test higher levels in the weeks ahead. Until BTC dominance decisively breaks below 62% and ETH/BTC strengthens further, Bitcoin will likely continue capping alternative layer growth. This is a reflexive rally, not yet a structural shift.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.