As user numbers decline and funding slows, the once-hyped web3 gaming sector appears to be approaching a potential crossroads.

Blockchain gaming had a tough second quarter in 2025 as daily user activity dropped by 17%, and more than 300 gaming decentralized applications went inactive. To make things look worse: investments in crypto games fell to a two-year low. And yet, despite all that, traditional gaming giants like Sega, Ubisoft, and FIFA continued moving into web3.

Analysts say that even though the market is in a downturn, the long-term potential is still relatively strong, and some developers and brands are quietly preparing for the next big breakout.

According to data compiled by DappRadar’s blockchain analyst Sara Gherghelas, the first quarter of 2025 showed just how fragile many early web3 games still are.

“Dozens of Web3 games shut down, funding continued its decline, and user activity dipped across the board. From overhyped MMORPGs to play-to-earn battlers, many titles simply couldn’t survive the harsh market conditions, whether due to dried-up investor backing, poor retention, or unsustainable tokenomics.”

Sara Gherghelas

At the same time, broader crypto market conditions added more pressure. Data from Delphi Digital earlier showed that most crypto sectors performed worse than Bitcoin (BTC). AI frameworks lost over 84% of their value. Agent-based projects were down more than 70%. Memecoins dropped by 51%, and even gaming infrastructure saw losses above 50%. In comparison, Bitcoin’s return only fell about 5%, while Ethereum (ETH) and Solana (SOL) each declined roughly 25%.

The decline came as a surprise, especially since a Binance survey late last year found that nearly half of users expected AI tokens and memecoins to lead the market in 2025. But that optimism didn’t play out. Many of these sectors became oversupplied or suffered from hype that didn’t match actual use. The same happened to web3 gaming in some areas, where early “play-to-earn” models couldn’t hold up over the longer term.

Not over yet

Even so, momentum still seems to be building behind the scenes. Back in February, Immutable co-founder Robbie Ferguson said that multiple gaming companies worth over $1 billion were now open to launching their own tokens. He noted that some of them are publicly traded and wouldn’t have considered tokens just a year ago.

Per Ferguson, 2025 is compressing years of development into a much shorter timeframe. He also believes that this shift could lead to higher-quality blockchain games and more serious token economies that are actually useful to players.

Meanwhile, Q2 still had some positive signs. Although gaming activity dropped to 4.8 million daily users — the lowest since early 2023 — certain chains and games showed strength. Data from DappRadar shows that the opBNB blockchain led by active wallets, while WAX led in the number of transactions, suggesting that players on WAX were more deeply engaged. Newer chains like Aptos, Sei, and SKALE also saw more gaming traffic.

The game “Off the Grid” stood out by gaining strong momentum on GUNZ, a custom Avalanche subnet. Even though it was still in testing, some users had already started using its mainnet.

Not everyone survived, though. According to DappRadar, over 300 games listed as active in Q1 had no on-chain activity in Q2. Some of them may have shut down completely, while others may have paused updates, switched blockchains, or just failed to keep up with smart contract upgrades. Gherghelas suggested that this reflects how fast things change in a still young and fairly experimental industry.

Some of the biggest closures were Ember Sword, which failed to raise more money despite earlier hype; Nyan Heroes, which collapsed after its token lost almost all its value; Realms of Alurya, which was paused after a key grant was pulled; Mojo Melee, whose team pivoted to building AI movie tools instead of games; and The Walking Dead: Empires, which will remain playable only until the end of July.

Even the metaverse space saw mixed results. Trading volume for metaverse NFTs fell 26% this quarter, but the number of sales actually rose by 54%, meaning prices were down but activity was up.

Yuga Labs opened 24/7 access to its Otherside metaverse. Animoca’s Mocaverse launched its own layer 1 chain focused on identity and data ownership. Pixels slowed down its growth push to focus on better gameplay and is planning a mobile spin-off called Pixels Pals for later this year. The Sandbox ran a massive 40-experience season and started working with Cirque du Soleil on a metaverse crossover.

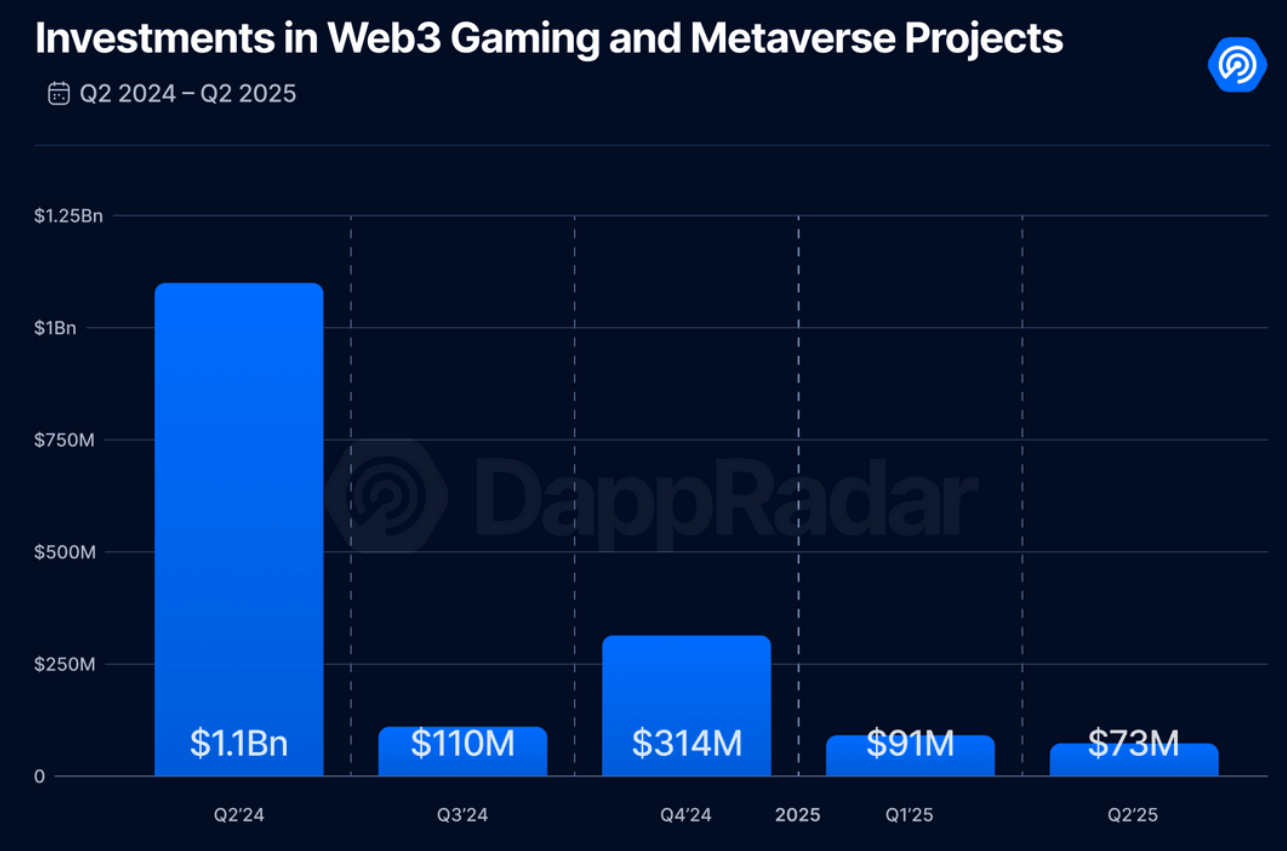

Gherghelas notes that while funding has fallen — only $73 million was raised in Q2, down 93% from the same time last year — most of that money went to infrastructure projects, not games. For example, Ultra raised $12 million to expand its publishing platform, MagicBlock raised $7.5 million for a real-time gaming engine on Solana, and Cooking.City raised $7 million to build a cooking game with token rewards.

She added that strong infrastructure and patient development will matter more than hype going forward. The flashy cycle of 2021 and 2022 may be over, but the groundwork for the next phase is being laid right now.