ZORA, the native token of the Zora network, may be headed for a short-term correction, with technical indicators flashing bearish signals.

According to data from crypto.news, Zora (ZORA) surged by 28% to hit an intraday high of $0.0128 on June 5, pushing its market cap above $40 million. However, the rally was short-lived.

Prices quickly retraced a chunk of those gains, even as daily trading volume spiked more than 150% in the last 24 hours, a possible sign of distribution by early holders.

ZORA initially rallied after South African hip-hop artist Jaykatana revealed that his latest track, “SIZOKUTHOLA”, was launched on the Zora Network, building on an earlier partnership that began in May.

For those unfamiliar, Zora is a Layer-2 blockchain designed to make it easy for users to tokenize and own on-chain media, including music, images, and social content from decentralized social apps.

However, the recent price action contrasts sharply with the platform’s underlying network activity.

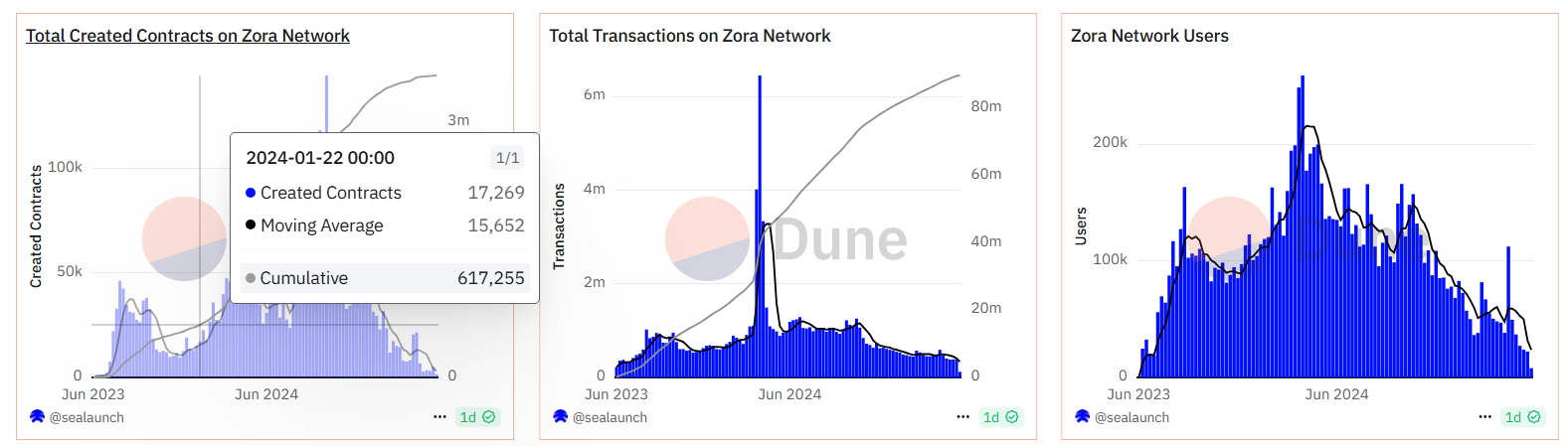

On-chain metrics suggest that Zora has been facing a sustained decline in usage. According to Dune Analytics, the total number of smart contracts created on Zora dropped from 144,402 on Oct. 14, 2024, to just 1,549 as of June 2.

Likewise, the number of transactions has fallen from an all-time high of 6.45 million to just 121,000, while active users have slid from nearly 259,000 to around 8,000.

These figures indicate that, despite renewed hype from artist collaborations, overall user engagement and developer activity on the Zora network continue to weaken.

ZORA price analysis

On the 4-hour chart, ZORA recently broke out above a descending trendline that had been capping price action since May 26, which helped trigger the latest price bounce.

However, zooming out reveals a more concerning setup. ZORA has formed a double-top pattern near the $0.013 level, with peaks on May 11 and May 26. This is typically seen as a bearish reversal signal, especially when followed by weakening momentum.

The token is also close to dipping below its 20-day Exponential Moving Average, and the MACD indicator looks close to flipping bearish with a potential crossover below the signal line. Additionally, the Relative Strength Index is trending downward, suggesting fading buying pressure.

Given the weakening fundamentals and bearish technical indicators, there is a strong likelihood that ZORA could be on track to retest the $0.0090 support zone, which has held up as a reliable floor since the token’s launch. That would mark a roughly 15% drop from current levels.

On the flip side, if bulls manage to reclaim the $0.012 resistance, which also lines up with the 61.8% Fibonacci retracement level, it would invalidate the bearish outlook and potentially open the door for another leg up.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.